Performance Analysis of Our Strategies

Maximize Your Portfolio’s Potential

Every asset class has distinct characteristics. We provide detailed performance metrics—including returns, drawdowns, and Sharpe ratios—to help you choose the right strategy for each market condition. Our tables and graphs make it easy to see which strategies perform best for specific assets.

Adaptive Strategy Portfolio

Our portfolio of strategies is designed to thrive in various market environments. By combining strategies with low correlation, we aim to:

-

Capture Opportunities across multiple market segments.

-

Reduce Volatility through diversification.

-

Enhance Performance by adapting to current market conditions

At TechQuantTrading, we know that each asset class requires a unique approach. Our diverse strategies are tailored to capture the best opportunities in equities, bonds, forex, and commodities. By leveraging their strengths, we offer diversified exposure that maximizes portfolio performance

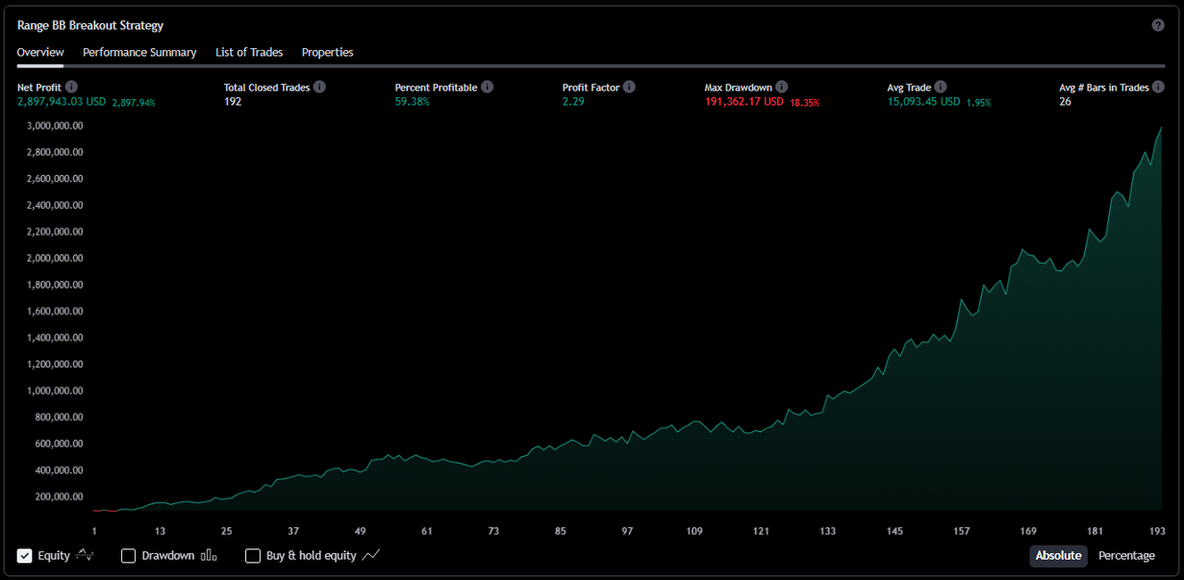

Performance of our flagship strategies

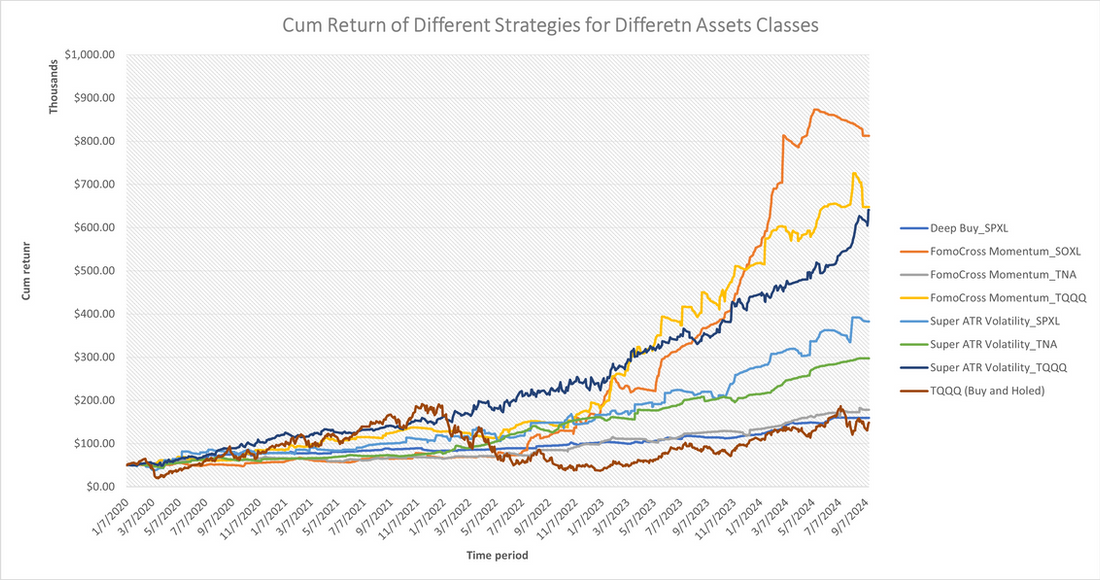

Unveiling Our Advanced Algorithms: Building an Uncorrelated Portfolio vs. Traditional Investments

The "Graph" below illustrates the cumulative returns of our flagship strategies tailored for various asset classes, each designed to reflect the unique characteristics of the indices they track. This diversified approach optimizes performance and reduces correlation, providing balanced exposure to different segments of the economy. Our aim is to offer a robust portfolio of strategies that adapts to changing market conditions, helping you achieve consistent growth and risk-adjusted returns.